There is a $10 billion opportunity to rebuild the hospitality industry.

inKind Series A

Typical Forms of Restaurant Financing

All failed during COVID

All failed during COVID

- Equity Investments

Very high riskRely on profits and great operators to get paid back which is rare. Even great operators couldn't make distributions during COVID. - Loans

High riskRely on the restaurant choosing to make a monthly payment and staying open for many years. It was very hard to collect on these loans during COVID. - Merchant Cash Advances

High riskPut significant financial stress on restaurants that already can't pay their bills, creating high default rates. Losses were so large to these lenders that 99% have stopped during COVID.

There is $10B in restaurant infrastructure now empty because of COVID.

As the world reopens, inKind is uniquely positioned to solve these problems and own this entire market.

Our Story

inKind is a financing solution that was invented by restauranteurs, not bankers.

In 2015, Andrew Harris and Johann Moonesinghe founded the first restaurant incubator to help chefs in Washington, DC.

For 5 years, they oversaw operations and financing at the 18,000 sq/ft restaurant, becoming experts in all aspects of restaurants and hospitality.

Hospitality has always been at the heart of everything we do.

For 5 years, they oversaw operations and financing at the 18,000 sq/ft restaurant, becoming experts in all aspects of restaurants and hospitality.

Hospitality has always been at the heart of everything we do.

We found that restaurant financing was fundamentally broken, so we fixed it.

How it works

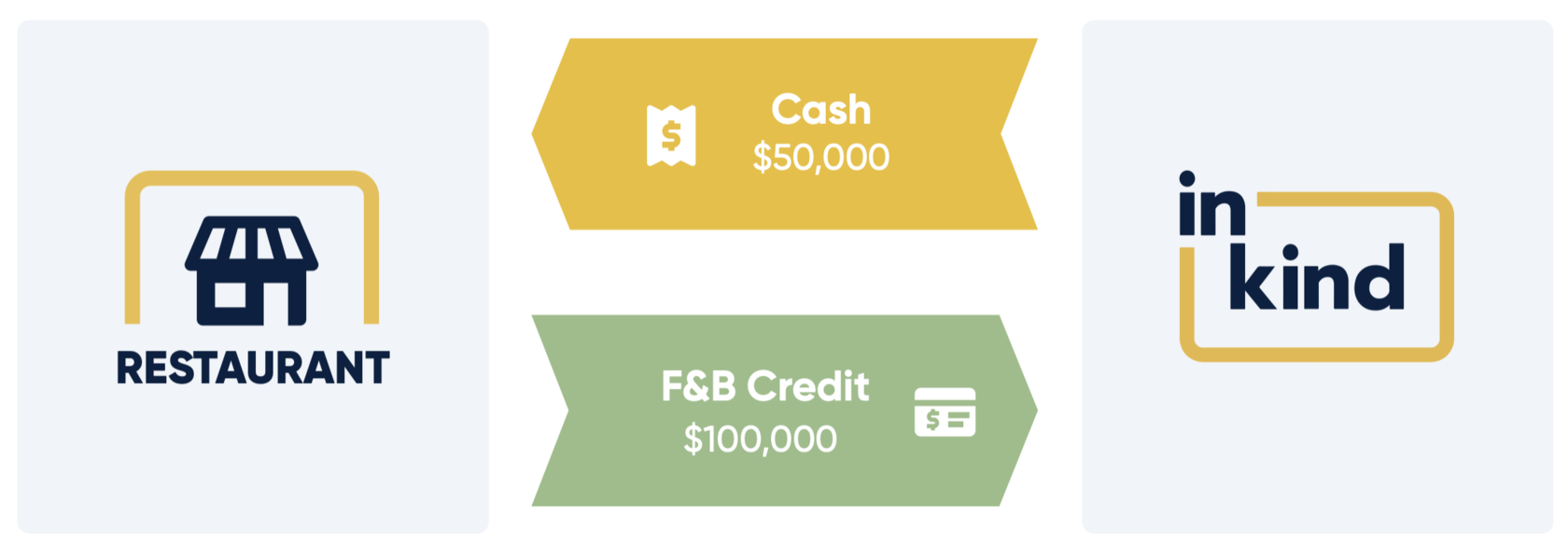

inKind provides capital to restaurants by purchasing large amounts of food and beverage credit.

inKind's financing is non-dilutive and is not a loan. It doesn't need to be repaid.

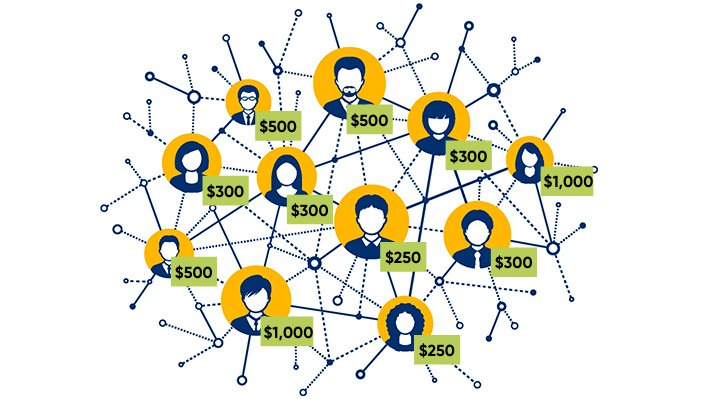

inKind sells the food & beverage credit to consumers through multiple online channels, adding to our consumer network.

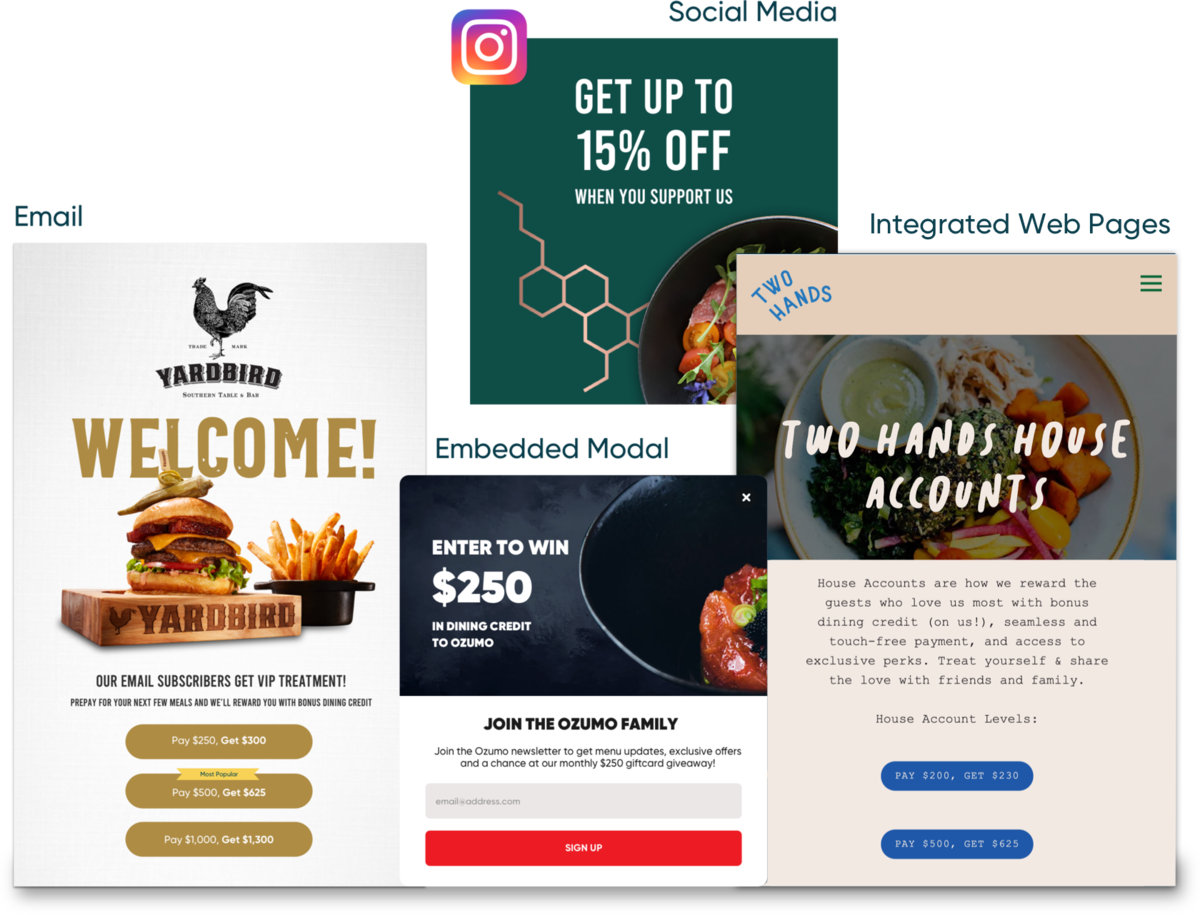

inKind's marketing engine ensures food and beverage credit sales are highly targeted and effective

inKind sells credit through a range of channels (online marketing, social media, reservation reminders).

We obtain the restaurant's mailing list and social accounts to target marketing to customers who know and love the business.

We have built automated systems and campaigns to (i) acquire users and (ii) ensure users top up with additional credit when low.

A Win-Win

inKind is a modern financing solution that is great for restaurants and customers.

RestaurantsNo equity dilution or loan to be repaid: restaurants simply provide meals to guests who buy the food & beverage credit.

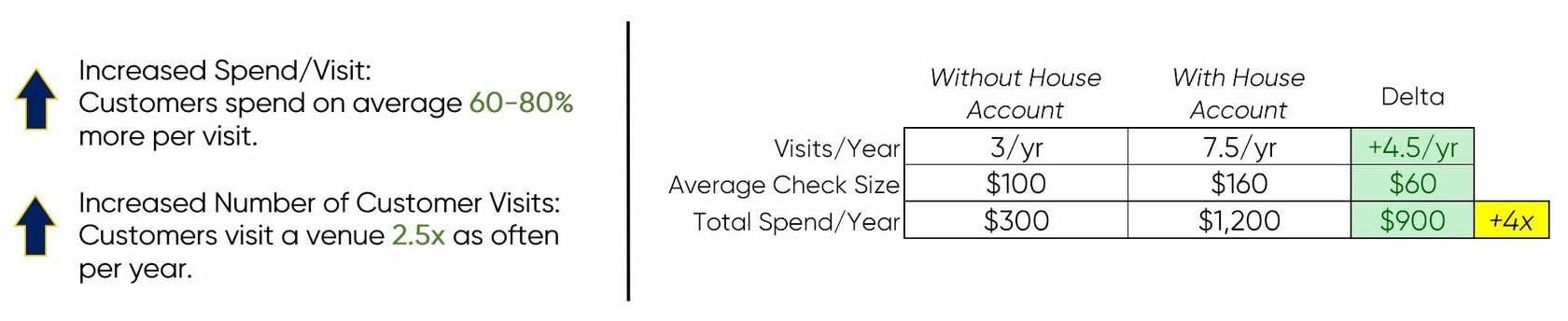

RestaurantsNo equity dilution or loan to be repaid: restaurants simply provide meals to guests who buy the food & beverage credit. CustomersGuests get a bonus when they buy food & beverage credit (house accounts). Our data shows that a guest will spend 400% more once they buy a house account.

CustomersGuests get a bonus when they buy food & beverage credit (house accounts). Our data shows that a guest will spend 400% more once they buy a house account.

inKind is a WIN for restaurants

Our low cost of capital allows us to sign up great restaurants and groups.

Our low cost of capital allows us to sign up great restaurants and groups.

inKind is a WIN for customers

By prepaying, customers get a discount to dine at the restaurants they love.

By prepaying, customers get a discount to dine at the restaurants they love.

Customer Behavior

Our data shows that House Account holders spend 400% more at a venue per year.

Our Portfolio

inKind can work with restaurants of all sizes.

Enterprise Groups

Our portfolio consists of reputable, world-class restaurant groups backed by some of the largest food-focused venture capital and private equity firms.

These groups have proven concepts and are using inKind funding to expand existing operations.

These groups have proven concepts and are using inKind funding to expand existing operations.

Case Study: Yardbird

$117,000

May 2021 revenue

$220,000

Expected profit

35,000+

New email subscribers

Independent Restaurants

Our portfolio also consists of independent restaurants.

THAMEE STORY

inKind Technology Integrations

inKind is integrated with several point of sales, reservation, and marketing clients, allowing us to work with restaurants with differing tech stacks.

Future Applications of Data

Targeted Marketing Solutions

- Identifying Loyal CustomersWe create premium experiences for high value customers.

- IntegrationsSeamless experiences with other pre-pay vendors and hospitality technologies.

- Trend AnalysisHone in on customer trends and preferences, down to the ingredient level.

Risk Mitigation

Reasons for risk mitigation in the restaurant asset class:

- Quick TurnaroundinKind typically sells out of consumer food & Bev credit in 4-8 months, and is not tied to the long term outcome of the restaurant.

- Unique UnderwritinginKind's underwriting process identifies good operators and loan candidates based on unique qualification metrics.

- Untouched CashflowUnlike loans and equity investments, inKinds capital leaves monthly cashflow largely untouched and cost is only incurred when a patron redeems credit reducing financial strain on client.

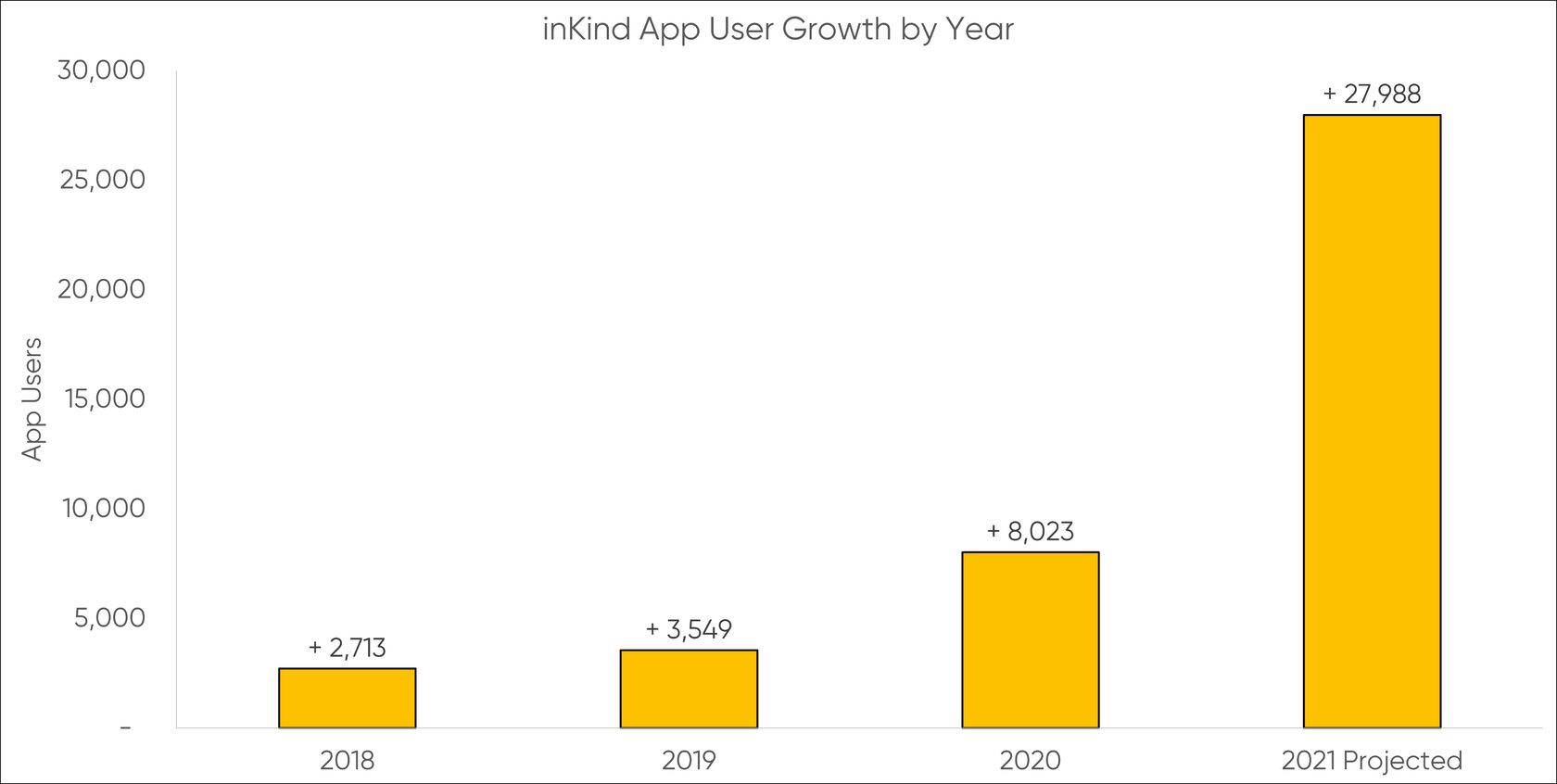

An Engaged User Base:

25,634

inKind App Users

$232

Average purchase amount

****3.52x

Average purchases per user

Future Growth Opportunities

25

Restaurant Groups in Our Sales Pipeline

$50MM

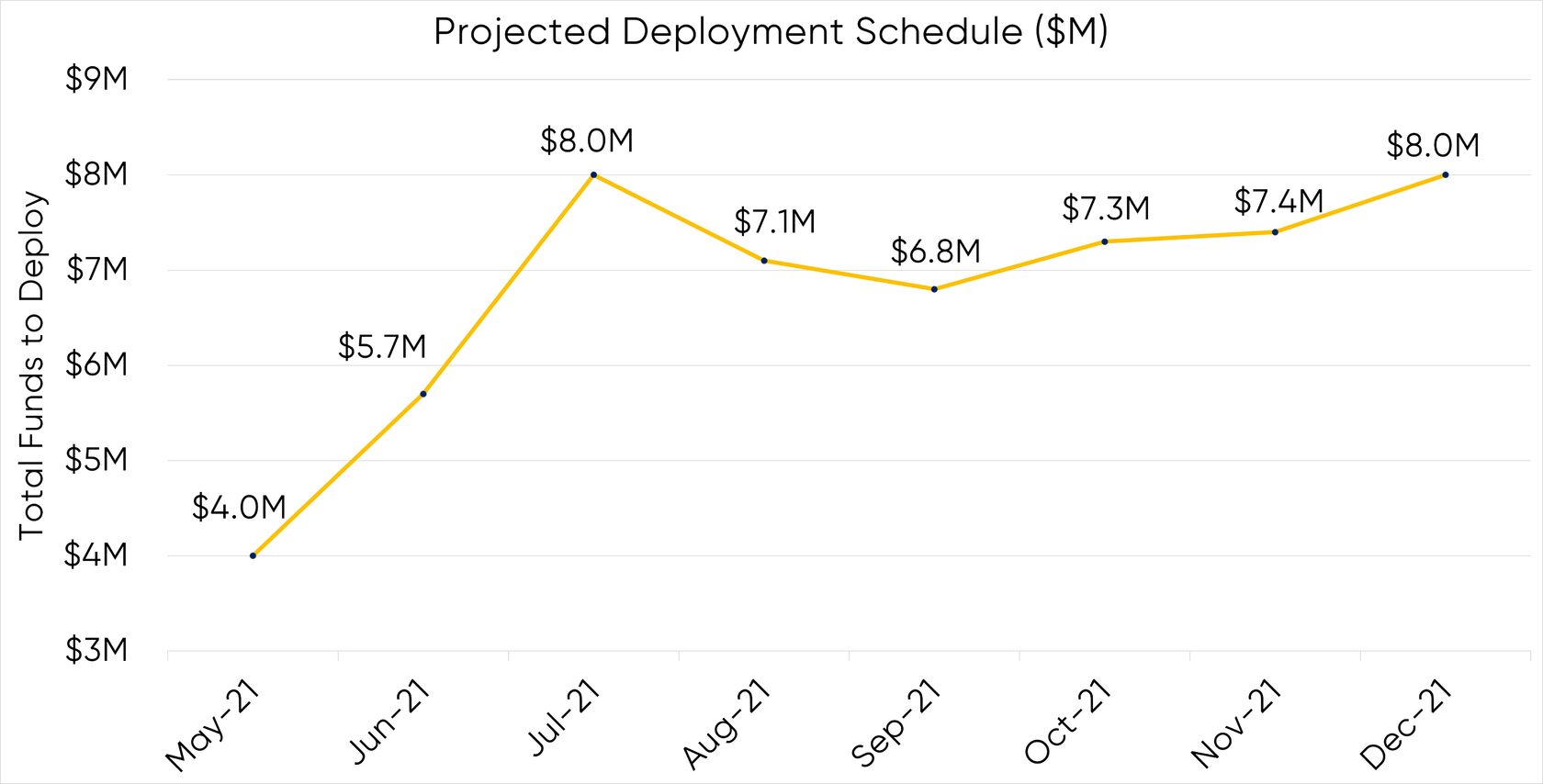

Signed Capital Commitments in Q1 2020

$56MM

Projected Capital Deployment Needs Over the Next 12 Months

Navigating a COVID-19 Hospitality Climate

Getting things done is a process. It demands accountability, and has clear goals. Follow through is the most valuable asset to any organisation. Successful teams ask questions, evaluate reality, and navigate toward specific solutions.

Financials

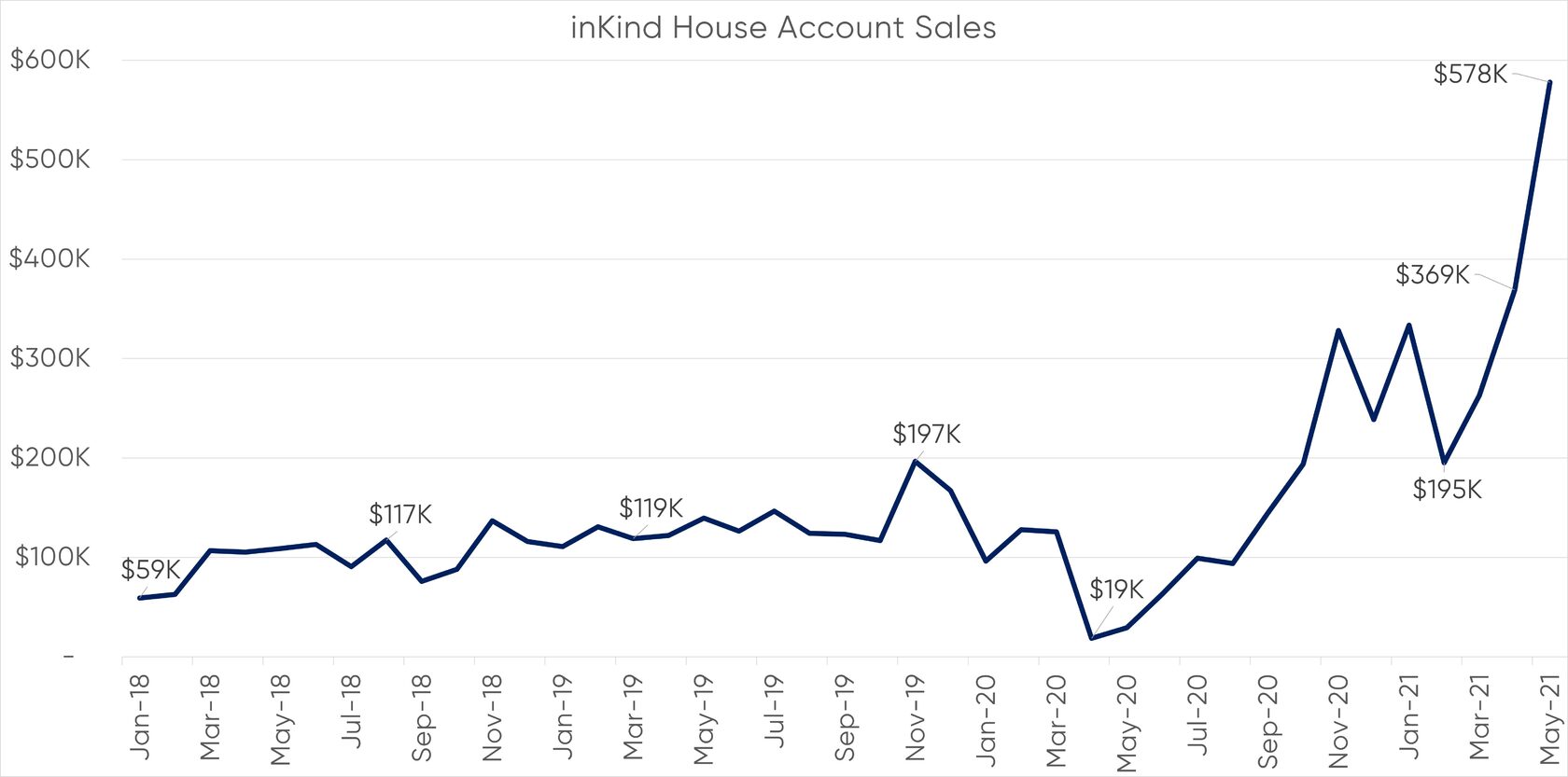

Revenue from the sale of House Accounts has increased 73% since January 2021.

Key Financials

- Revenue ForecastsRevenue is projected to reach $800k/month by the end of 2021

- Burn/Run rate$9.6MM run rate

Our Clients Love Us

The inKind Team--the right team

- Johann MoonesingheCo-Founder / CEO

- Andrew HarrisCo-Founder / COO

- Derek KellerChief Financial Officer

- Bryan CrowCTO

- Sarah Marie GlassHead of Marketing

- Matt SaetaCo-Founder / Head of Partnerships

- Raj MoonesingheCo-Founder / Sales Exec

- Marcus TriestHead of Product

Seeking $5MM to scale up operations

inKind has built a scalable solution, and has demand from seasoned restaurant operators. Our Series A will allow us to get to a $100m run rate within 18 months.

Talent

Onboard additional hires:

- Vice President of Marketing

- Head of Capital Markets

- Developers

- Marketing Analytics

- Vice President of Marketing

- Head of Capital Markets

- Developers

- Marketing Analytics

Resources

Allocation for additional partnership integrations, product improvements, account sales, user growth, data analysis and machine learning underwriting.

Growth of Debt

Complete our $100m debt raise into inKind Credit Fund.

Book a meeting or dinner with us.

Want to sit down with our CEO Johann Moonesinghe?

Leave your contact information and we'll set a time!

Leave your contact information and we'll set a time!

Let us know a little more

Enter your details below and we'll set a time!

THIS WEBPAGE IS BEING FURNISHED BY OR ON BEHALF OF INKIND CARDS, INC. ("INKIND") ON A CONFIDENTIAL BASIS TO THE RECIPIENT SOLELY FOR THE LIMITED PURPOSE OF PROVIDING CERTAIN GENERAL INFORMATION ABOUT INKIND'S BUSINESS AND OPERATIONAL CAPABILITIES.

THE INFORMATION CONTAINED IN THIS WEBPAGE IS NOT, AND MAY NOT BE RELIED ON IN ANY MANNER, AS LEGAL, TAX, INVESTMENT, ACCOUNTING OR OTHER ADVICE OR AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY AN INTEREST IN ANY PRIVATE FUND OR ACCOUNT THAT MAY BE OFFERED BY INKIND OR ANY OF ITS AFFILIATES (EACH, A "FUND").

BY ITS ACCEPTANCE HEREOF, EACH RECIPIENT OF THIS WEBPAGE ACKNOWLEDGES AND AGREES THAT THIS WEBPAGE MAY NOT BE REPRODUCED OR PROVIDED TO OTHERS, IN WHOLE OR IN PART, NOR MAY ITS CONTENTS BE DISCLOSED WITHOUT THE PRIOR WRITTEN CONSENT OF INKIND, AND THAT THE RECIPIENT WILL KEEP CONFIDENTIAL ALL INFORMATION CONTAINED HEREIN NOT ALREADY IN THE PUBLIC DOMAIN.

THE PROJECTED RETURNS OR OTHER INFORMATION SET FORTH IN THIS WEBPAGE (THE "PROJECTIONS") ARE HYPOTHETICAL, HAVE BEEN PREPARED AND ARE SET OUT FOR ILLUSTRATIVE PURPOSES ONLY, AND DO NOT CONSTITUTE FORECASTS OR GUARANTEES OF FUTURE EVENTS. THEY HAVE BEEN PREPARED BASED ON INKIND'S CURRENT VIEW IN RELATION TO FUTURE EVENTS AND FINANCIAL PERFORMANCE OF EXISTING INVESTMENTS MADE BY INKIND AND VARIOUS ESTIMATIONS AND ASSUMPTIONS MADE BY INKIND.

THE ADOPTION OF THE TARGET RETURNS PRESENTED HEREIN IS NOT INTENDED TO PREDICT THE PERFORMANCE OF INKIND. INSTEAD, THE TARGET RETURNS ARE INTENDED TO PROVIDE ADDITIONAL CONTEXT WITH RESPECT TO INKIND'S INVESTMENT STRATEGY. THE ULTIMATE RETURNS REALIZED BY INKIND WILL DEPEND ON NUMEROUS FACTORS AND ARE SUBJECT TO A VARIETY OF RISKS. THERE CAN BE NO ASSURANCE THAT INKIND WILL ACHIEVE ITS OBJECTIVES OR THAT INKIND WILL BE ABLE TO IMPLEMENT ITS INVESTMENT STRATEGY. AS WITH ALL INVESTMENTS, PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RETURNS OF INKIND.

CERTAIN INFORMATION ON THIS WEBPAGE CONSTITUTES "FORWARD-LOOKING" STATEMENTS WHICH CAN BE IDENTIFIED BY THE USE OF FORWARD-LOOKING TERMINOLOGY SUCH AS "MAY," "WILL," "SHOULD," "EXPECT," "ANTICIPATE," "ESTIMATE," "INTEND," "PROJECT," "TARGET," "CONTINUE" OR "BELIEVE" OR THE NEGATIVES THEREOF OR OTHER VARIATIONS THEREON OR COMPARABLE TERMINOLOGY. FURTHERMORE, ANY PROJECTION OR OTHER ESTIMATES IN THIS PRESENTATION INCLUDING ESTIMATES OF RETURNS OR PERFORMANCE, ARE "FORWARD LOOKING STATEMENTS" AND ARE BASED UPON CERTAIN ASSUMPTIONS THAT MAY CHANGE. DUE TO VARIOUS RISKS AND UNCERTAINTIES, ACTUAL EVENTS OR RESULTS OR THE ACTUAL PERFORMANCE OF THE FUNDS DESCRIBED HEREIN MAY DIFFER MATERIALLY FROM THOSE REFLECTED OR CONTEMPLATED IN SUCH FORWARD-LOOKING STATEMENTS. RECIPIENTS OF THIS WEBPAGE SHOULD PAY CLOSE ATTENTION TO THE ASSUMPTIONS UNDERLYING THE ANALYSES AND FORECASTS CONTAINED HEREIN.

FOR BUSINESS AND PROFESSIONAL INVESTORS ONLY. NOT FOR DISTRIBUTION TO THE GENERAL PUBLIC.

THE INFORMATION CONTAINED IN THIS WEBPAGE IS NOT, AND MAY NOT BE RELIED ON IN ANY MANNER, AS LEGAL, TAX, INVESTMENT, ACCOUNTING OR OTHER ADVICE OR AS AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY AN INTEREST IN ANY PRIVATE FUND OR ACCOUNT THAT MAY BE OFFERED BY INKIND OR ANY OF ITS AFFILIATES (EACH, A "FUND").

BY ITS ACCEPTANCE HEREOF, EACH RECIPIENT OF THIS WEBPAGE ACKNOWLEDGES AND AGREES THAT THIS WEBPAGE MAY NOT BE REPRODUCED OR PROVIDED TO OTHERS, IN WHOLE OR IN PART, NOR MAY ITS CONTENTS BE DISCLOSED WITHOUT THE PRIOR WRITTEN CONSENT OF INKIND, AND THAT THE RECIPIENT WILL KEEP CONFIDENTIAL ALL INFORMATION CONTAINED HEREIN NOT ALREADY IN THE PUBLIC DOMAIN.

THE PROJECTED RETURNS OR OTHER INFORMATION SET FORTH IN THIS WEBPAGE (THE "PROJECTIONS") ARE HYPOTHETICAL, HAVE BEEN PREPARED AND ARE SET OUT FOR ILLUSTRATIVE PURPOSES ONLY, AND DO NOT CONSTITUTE FORECASTS OR GUARANTEES OF FUTURE EVENTS. THEY HAVE BEEN PREPARED BASED ON INKIND'S CURRENT VIEW IN RELATION TO FUTURE EVENTS AND FINANCIAL PERFORMANCE OF EXISTING INVESTMENTS MADE BY INKIND AND VARIOUS ESTIMATIONS AND ASSUMPTIONS MADE BY INKIND.

THE ADOPTION OF THE TARGET RETURNS PRESENTED HEREIN IS NOT INTENDED TO PREDICT THE PERFORMANCE OF INKIND. INSTEAD, THE TARGET RETURNS ARE INTENDED TO PROVIDE ADDITIONAL CONTEXT WITH RESPECT TO INKIND'S INVESTMENT STRATEGY. THE ULTIMATE RETURNS REALIZED BY INKIND WILL DEPEND ON NUMEROUS FACTORS AND ARE SUBJECT TO A VARIETY OF RISKS. THERE CAN BE NO ASSURANCE THAT INKIND WILL ACHIEVE ITS OBJECTIVES OR THAT INKIND WILL BE ABLE TO IMPLEMENT ITS INVESTMENT STRATEGY. AS WITH ALL INVESTMENTS, PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RETURNS OF INKIND.

CERTAIN INFORMATION ON THIS WEBPAGE CONSTITUTES "FORWARD-LOOKING" STATEMENTS WHICH CAN BE IDENTIFIED BY THE USE OF FORWARD-LOOKING TERMINOLOGY SUCH AS "MAY," "WILL," "SHOULD," "EXPECT," "ANTICIPATE," "ESTIMATE," "INTEND," "PROJECT," "TARGET," "CONTINUE" OR "BELIEVE" OR THE NEGATIVES THEREOF OR OTHER VARIATIONS THEREON OR COMPARABLE TERMINOLOGY. FURTHERMORE, ANY PROJECTION OR OTHER ESTIMATES IN THIS PRESENTATION INCLUDING ESTIMATES OF RETURNS OR PERFORMANCE, ARE "FORWARD LOOKING STATEMENTS" AND ARE BASED UPON CERTAIN ASSUMPTIONS THAT MAY CHANGE. DUE TO VARIOUS RISKS AND UNCERTAINTIES, ACTUAL EVENTS OR RESULTS OR THE ACTUAL PERFORMANCE OF THE FUNDS DESCRIBED HEREIN MAY DIFFER MATERIALLY FROM THOSE REFLECTED OR CONTEMPLATED IN SUCH FORWARD-LOOKING STATEMENTS. RECIPIENTS OF THIS WEBPAGE SHOULD PAY CLOSE ATTENTION TO THE ASSUMPTIONS UNDERLYING THE ANALYSES AND FORECASTS CONTAINED HEREIN.

FOR BUSINESS AND PROFESSIONAL INVESTORS ONLY. NOT FOR DISTRIBUTION TO THE GENERAL PUBLIC.